Lockdown measures have forced shoppers to stay at home and turn to online stores for the goods they need. This drastic shift in shopping has the potential to change the sector permanently, leaving big opportunities for retailers who get the right strategy in place.

Has COVID-19 Affected eCommerce Bottom Lines?

For many eCommerce brands, lockdown hasn’t affected their bottom line too much. In fact, in some cases, it has even increased.

But is this shift temporary or are we looking at a new landscape for eCommerce in the future?

At the start of lockdown, many brick and mortar stores rushed to get their goods online after they were forced to shut their physical doors by government decree, but is this enough?

Will this new spotlight on eCommerce stay now that lockdown measures have been eased? Or will brands have to create a new reality in order to grow their stores and tap into the changing behaviours of their loyal customers?

With this in mind, let’s take a look at the new strategies eCommerce brands are having to put in place to continue to serve as well as the opportunities they should be latching on to.

The Changes in Consumer Behaviour

COVID-19 has forced a change in consumer priorities. The need to stay in and stay safe has overridden trivial consumer needs of the past, like the desire to have the latest products and a new wardrobe for every season.

Safety is now more important than shopping – and for good reason. But this doesn’t mean the end of consumerism as we know it; ecommerce brands simply need to mix up their approach to tie into these new priorities.

This means finding ways to serve customers that align with their current needs whilst keeping supply chains intact at the same time (this is particularly true for non-essential sellers that may have seen a drop in sales).

In a survey commissioned by global commerce services company PFS, it was revealed that three in five consumers (60%) have purchased more goods since the lockdown began than they did before. On top of this, 53% have upped the amount of shopping they do online with the majority of consumers dramatically reducing the amount of physical stores they go to.

The survey explored the new shopping habits of consumers and their changing buying behaviour, but it also looked into their expectations from brands during this time. Unsurprisingly, consumers wanted brands to be sympathetic to the current climate, tone down brash marketing, and be flexible in their approach.

Which eCommerce Brands Will Be Most Affected?

PFS’s study also dug into the success rates of different eCommerce sectors.

While some sellers experienced a wave of higher sales (19% of consumers understandably reported buying more healthcare items and 25% bought more home, garden, and DIY products online), others saw sales flop.

A quarter of consumers claimed their clothes buying habits had significantly decreased – with 53% claiming they’re spending less on fashion because they’re not going out – and 18% said they’ve bought fewer cosmetic items and luxury goods.

This is reflected in the sales numbers of high street stores and luxury retailers. H&M reported a 57% drop in sales between 1st March and 6th May and Hugo Boss noted a definite decline in sales. The exemption seems to be independent fashion retailers who have seemingly bucked the trend, with many managing to keep sales fairly buoyant during lockdown.

eCommerce brands that appear to be thriving during the pandemic include stores that sell home and garden products, gifts and accessories, health and fitness products, and food and drink.

The dramatic increase in order volume for home and garden goods. Source.

This is no real surprise – gyms are shut, forcing fitness-conscious consumers to workout from home, the work-from-home rule has seen more people invest in their homes and gardens, and the number of supermarkets that sell out their delivery slots every single week shows the surge in people that are food shopping online.

However, this doesn’t mean that other brands are falling significantly behind. As sales begin to pick up again across the board, non-essential sellers can breathe a sigh of relief. The only problem is, they’re probably now sitting on stock that needs to go.

Where Are the Opportunities for Ecommerce Growth Post-Lockdown?

There are plenty of ecommerce providers paving the way post-lockdown. Zalando, Europe’s biggest online-only fashion retailer, reported an 11% uptick in sales – a new record high for the brand that’s set to increase even more.

But what are the companies that are succeeding doing right?

Digital Transformation

Zalando is first and foremost an online business. It started online, it remained online, and it thrived during lockdown. Unlike bricks and mortar stores that rushed to get their businesses on the internet pre-lockdown, Zalando has had plenty of time to create digital customer experiences that are enjoyable.

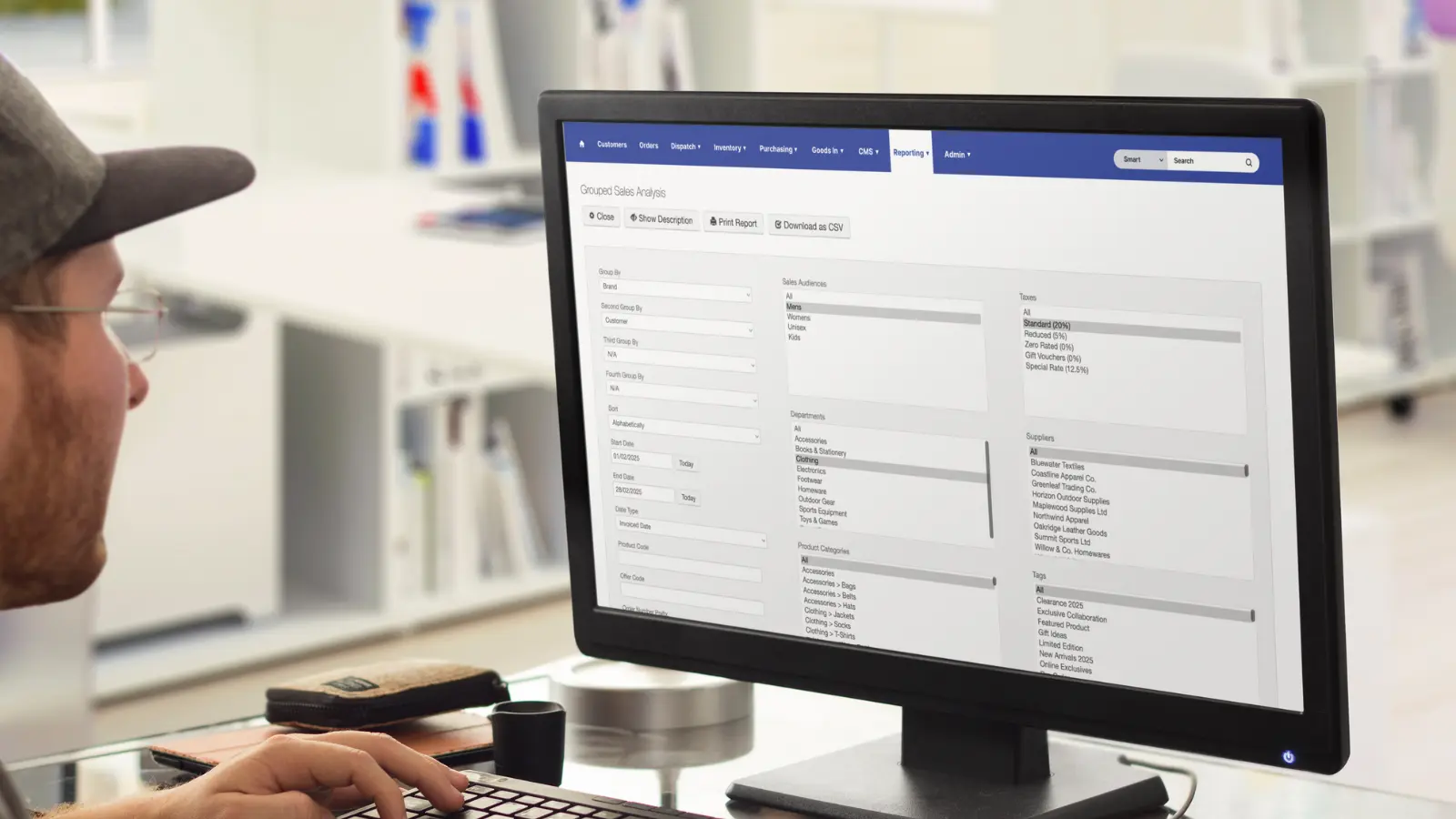

The eCommerce brands that will succeed post-COVID use past data to optimise the shopping process from start to finish.

This use of digital tools and software to create slick funnels and user-friendly shopping experiences was starting to gain traction before lockdown, but it’s now more important than ever to create real connections with customers who are stuck at home and unable to shop in the ways they are used to.

Adoption of Mobile Shopping

Stuck-at-home consumers are shocked by how much their screen time has increased during lockdown.

With not much else to do and the whole world at their fingertips, many have upped the amount of time they spend on their phones, using them to do everything from communicating with friends and family (this report shows a 45% increase in WhatsApp usage) to online shopping.

Brands that are able to incorporate mobile into the sales cycle will be able to tap into this growing pool of consumers who are shopping online via their phones.

Connect More Commerce Touchpoints

Even before lockdown was enforced, the large number of commerce brands taking their stores online has increased the competition. With more online stores than ever, capturing the attention of potential customers has become increasingly difficult.

As a result, brands that are growth-minded are having to incorporate more touch points along the buying journey to retain the dwindling attention of buyers. This includes features like chatbots that can provide auto responses to commonly asked questions, eliminating the chance of a consumer losing interest and going elsewhere.

Adding touch points throughout the journey keeps buyer engagement levels high and gives ecommerce brands an edge.

A Strategic Focus on Traffic From Key Areas

The most successful eCommerce brands know where their audiences hang out. Instead of spreading themselves thin and trying to attract buyers from every online hotspot they can think of, they identify their key traffic sources and optimise them.

Take clothing brand Barbour, for example. They’ve found a market for their product on Instagram and have optimised their strategy on the platform to increase store traffic by 98% and Instagram-fuelled sales by 42%.

Finding key traffic sources and strategically optimising them is an effective way to lean into what works and, ultimately, catapult growth.

Final thoughts

Right now, the future of eCommerce is in flex. We’re not fully out of lockdown yet and there are regularly new measures being put in place.

What we do know is that eCommerce brands that are doing well during these strange times are working hard to align themselves with changing consumer needs, as well as turning to key strategies that are hyper-focused and necessary in the wake of increasing competition.

Our recent posts

Keep up to date with the latest news and insight from the team at Venditan

.webp)

-p-2000.webp)

.webp)

.avif)